Obtain free Cryptocurrencies updates

We’ll ship you a myFT Every day Digest e mail rounding up the newest Cryptocurrencies information each morning.

Hey and welcome to the newest version of the FT’s Cryptofinance e-newsletter. This week, we’re looking at enterprise capital entering into crypto.

Enterprise capital may be fickle and chase traits as voraciously as any social media influencer however it’s not finished with crypto but.

Its function within the bubble of 2020-22 is plain: ultra-low rates of interest to stimulate the worldwide financial system after the pandemic generated free cash that was directed into hypothesis, and few property provided as a lot promise as crypto.

Rising coin costs had been parlayed into extra ventures to help valuations and the bubble inflated. The spectacular market crash coupled with rising rates of interest meant the one factor that dried up quicker than crypto’s unfulfilled guarantees had been the waves of recent cash coming in for the business to construct and experiment with.

Final 12 months buyers poured roughly $30bn value of capital into crypto tasks each in 2021 and in 2022, in accordance with numbers from capital markets knowledge supplier PitchBook.

In distinction, the worth of crypto offers in 2023 add as much as roughly $7bn and is at the moment on monitor to the touch about $10bn for the 12 months, a close to 70 per cent decline from final 12 months.

The cash now’s not going into tasks comparable to non-fungible tokens (keep in mind them?) or decentralised finance. As a substitute, PitchBook says, it’s being channelled into tasks seeking real-world makes use of for blockchain know-how. And with that has come a extra circumspect method — each to what corporations are doing and with whom they’re doing it.

“Everybody has been humbled in crypto, and what was actually required was to come back in just a little sceptical, somewhat than attempting to do an excessive amount of too rapidly,” stated Alex Felix, chief funding officer at CoinFund, a crypto-focused funding group primarily based in New York. CoinFund, one of many business’s oldest and most established crypto-focused funding companies, raised greater than $150mn earlier this summer time.

One of many large focuses now’s the tokenisation of property — reproducing securities as a token on a blockchain. Shifting authorized property on to digital ledger, in principle, means buying and selling could possibly be finished around the clock, as a substitute of solely throughout working hours and days.

It might additionally encourage extra liquidity in in any other case hard-to-shift property and bypass intermediaries that cost charges for his or her companies, comparable to brokers or securities depositories. At least Larry Fink, chief government of BlackRock and previous bitcoin critic, calls tokenisation the “subsequent era in markets”.

PitchBook estimates {that a} complete of 44 offers aimed toward infrastructure and developer instruments has risen to a cumulative $540mn 12 months to this point.

“In the event you’re an investor and also you’re a start-up constructing infrastructure, it’s simpler to know who they’re promoting to, what their enterprise mannequin appears like, and what their revenues may be,” stated Robert Le, crypto analyst at PitchBook.

Trident Digital Group this week introduced it had secured $8mn in seed funding to attempt to reinvigorate the useless crypto lending market, with higher and extra refined threat administration.

It talked about lending yields tied to so-called risk-free charges and full backing of property with US Treasuries. It bears some resemblance to a reverse repo transaction — and are ideas that buyers readily perceive. It’s actually simpler than “algorithmic stablecoin”.

The events it can work with are “prime tier” digital property exchanges. An individual conversant in the fundraising stated potential lenders don’t want publicity to Binance, which has been charged with a number of federal legislation violations by the US markets regulators.

“In the event you consider there’s a use case for tokenisation and blockchain know-how, then there’ll proceed to be individuals who make investments on this stuff,” stated one crypto-focused investor. “If it doesn’t die, then there’s worth in it. The ecosystem didn’t die, it simply took a really large punch to the face.”

It’s just a little odd to listen to a enterprise capitalist sound like a worth investor however there is perhaps methodology to it. Each VC wants an exit plan.

Blue-chip market operators are devoting extra vitality to this area. Final week the London Inventory Change Group stated there was sufficient curiosity from the market that it was drawing up plans for an “end-to-end” blockchain-based service protecting all the pieces from issuance and buying and selling to reconciliation and settlement. However it’s seemingly the group might want to purchase the correct know-how somewhat than construct it in-house.

Even so, some VCs nonetheless see hope within the guarantees of two years in the past. Brine Fi yesterday introduced a $16.5mn funding spherical led by notable names comparable to Pantera Capital and Elevation Capital. It’s centered on DeFi, a type of crypto buying and selling with no centralised authority.

However Brine Fi and its buyers are operating firmly in opposition to the grain. Based on PitchBook knowledge, within the first half of this 12 months solely 25 offers value $149mn had been devoted to the decentralised finance sector.

“I’ve spoken to a few VCs who don’t suppose the regulatory setting within the US goes to be a threat for decentralised finance, and that [the sector] is untouchable for regulators . . . I don’t suppose that’s true,” stated PitchBook’s Le.

What’s your tackle the crypto funding scene? As all the time, e mail me your ideas at scott.chipolina@ft.com.

Weekly highlights

-

The Worldwide Group of Securities Commissions this week issued nine policy recommendations to handle market integrity and investor safety considerations within the decentralised finance sector. The suggestions cowl six areas, together with understanding constructions in DeFi in addition to enforcement of relevant legal guidelines, and observe Iosco’s name earlier this 12 months on international regulators to be quicker and bolder on crypto markets.

-

Weeks earlier than Sam Bankman-Fried’s much-anticipated trial, one other former FTX government has pleaded guilty to criminal charges. Ryan Salame, who co-led FTX’s Bahamian unit FTX Digital Markets, has turn into the fourth former FTX government to make such a plea, seemingly bolstering the prosecution’s case in opposition to the previous crypto kingpin.

Soundbite of the week: Grayscale is operating out of endurance

Grayscale is feeling bullish after a US courtroom dominated final month that the Securities and Change Fee was wrong to reject the corporate’s utility to transform its flagship product right into a bitcoin-backed trade traded fund.

It means the SEC has to go away and rethink the justifications for its denial. The choose favoured Grayscale as a result of the regulator had allowed bitcoin ETFs that monitor futures on bitcoin. This week Grayscale’s attorneys Davis Polk despatched a letter to the regulator that did its finest to stuff its amusement into legalese.

“If every other motive could possibly be provided in making an attempt to distinguish spot bitcoin ETPs from bitcoin futures ETFs . . . we’re assured that it might have surfaced by now in one of many fifteen Fee orders that rejected spot bitcoin filings even after bitcoin futures ETPs started buying and selling.”

Knowledge mining: One other milestone crypto lull

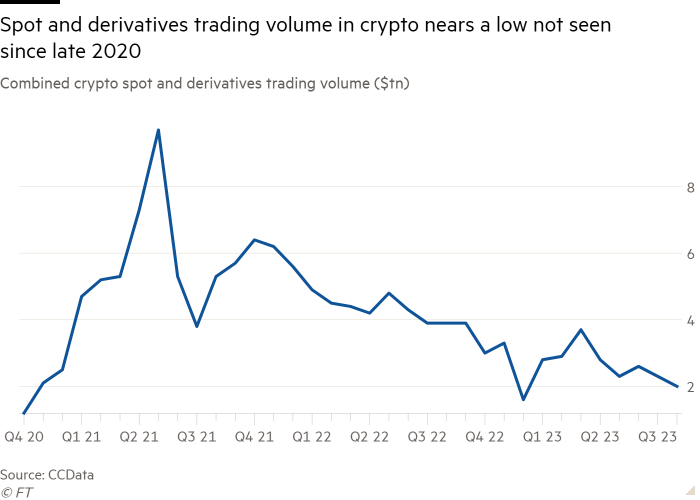

The mixed spot and derivatives volumes in crypto reached the bottom stage this 12 months in August. The aggregated buying and selling quantity for each markets on centralised exchanges fell greater than 11 per cent final month to only over $2tn, in accordance with numbers supplied by CCData.

Not solely is that this the bottom mixed month-to-month buying and selling quantity in 2023, it is usually the second-lowest mixed quantity on centralised exchanges since October 2020.

FT Cryptofinance is edited by Philip Stafford. Please ship any ideas and suggestions to cryptofinance@ft.com.