As an investor in DeFi, keeping track of digital assets across various platforms and blockchains can be a daunting task. This is where portfolio trackers like Zapper come into play. However, while Zapper is a powerful tool, many users are looking for a Zapper alternative that offers more comprehensive features and enhanced security.

De.Fi is a premier choice for those looking for an alternative to Zapper, providing a wide array of functionalities that cater to the evolving multichain needs of DeFi users.

What is Zapper?

Zapper is a well-known DeFi tracker that allows users to manage their DeFi assets and liabilities. It was designed to simplify the process of monitoring DeFi investments across multiple blockchains and protocols. With Zapper, users can connect their wallets to track their assets in real time, swap tokens, and explore various DeFi opportunities.

However, while Zapper offers a range of useful tools, it may not fully cater to the needs of every DeFi user, particularly those looking for more advanced features or specific asset tracking capabilities, along with those looking to combine a range of data sources, such as price movements, yields, and smart contract security. This has led to a rising demand for a comprehensive Zapper website alternative.

De.Fi: The Best Zapper Alternative

When comparing Zapper vs De.Fi, it’s clear that De.Fi provides attractive differentiation for users. De.Fi offers an expansive suite of features that go beyond basic portfolio tracking, addressing the multifaceted needs of modern DeFi users, ranging from opportunity seeking, to security auditing – something that, just 2 years ago, was the preserve of blockchain coders.

Here are just some of the features offered by the De.Fi SuperApp:

Extensive Chain and Asset Tracking

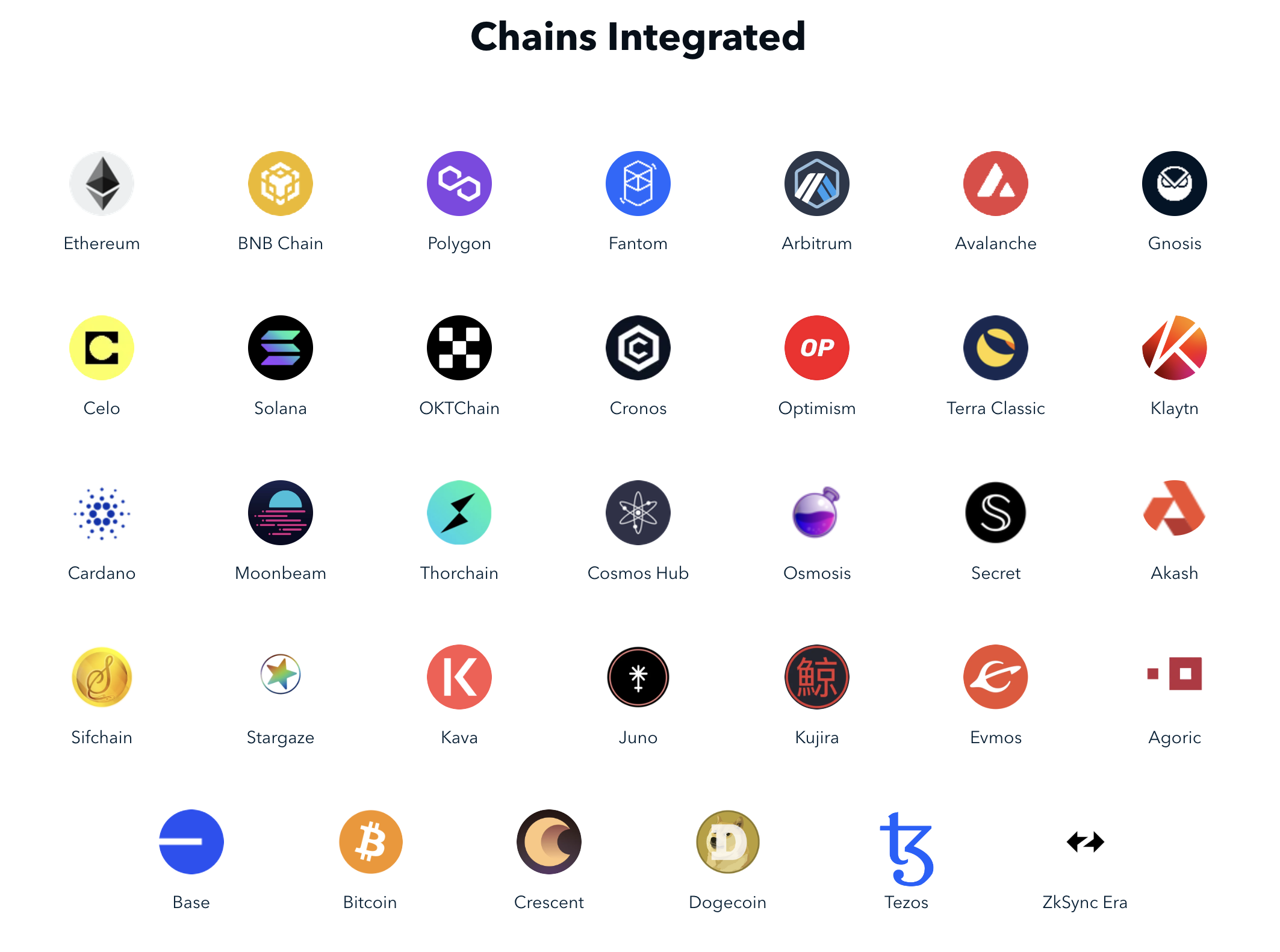

De.Fi distinguishes itself with its support for a vast range of chains and assets. Unlike Zapper, which primarily focuses on popular chains, De.Fi’s robust platform encompasses both popular and emerging blockchain networks. In fact, we were the first to support non-EVM chains such as Solana, Cosmos, and Cardano, allowing investors from all major ecosystems to track their assets seamlessly.

Not only that, De.Fi also supports tracking of popular centralized exchanges (CEXs) like Binance and OKX, allowing users to have a full view of their assets – not just what they hold in DeFi. This diversity ensures that users can manage a broad spectrum of assets from various ecosystems, all within a single dashboard.

Portfolio and Transactions Dashboards

The De.Fi platform stands out with its class-leading Portfolio and Historic Transactions dashboards, offering users an unparalleled level of detail and clarity in managing their digital assets.

Detailed Portfolio Dashboard

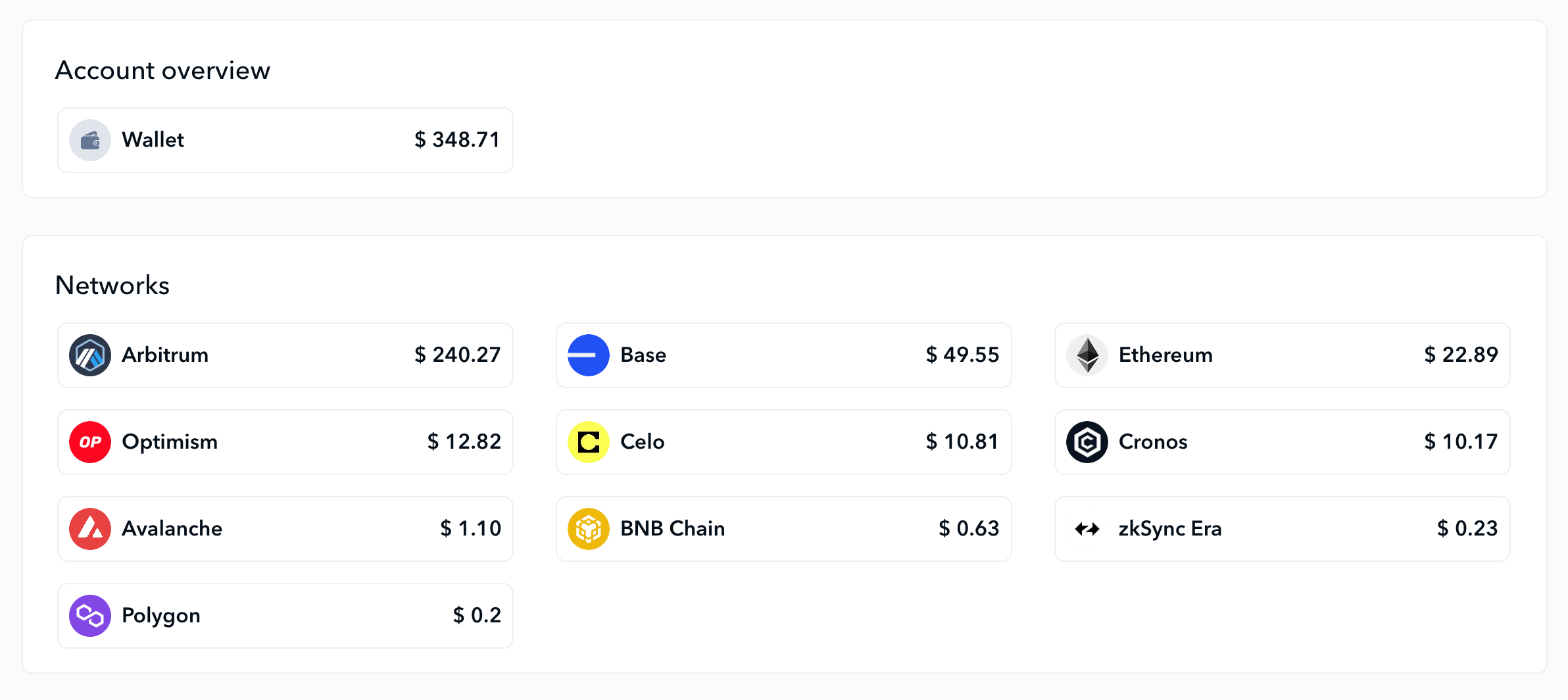

The Portfolio dashboard in De.Fi is thoughtfully segmented to give users a comprehensive view of their financial standing in the DeFi world:

Wallet: This section provides a real-time snapshot of the user’s available funds. It helps in quick decision-making by showing current balances across different cryptocurrencies, allowing users to assess their liquid assets at any moment.

Deposits: Here, users can view their staked assets across various protocols. This is particularly useful for DeFi users who participate in liquidity mining or staking pools. It assists in formulating strategies by showing where assets are deployed and estimating their potential returns.

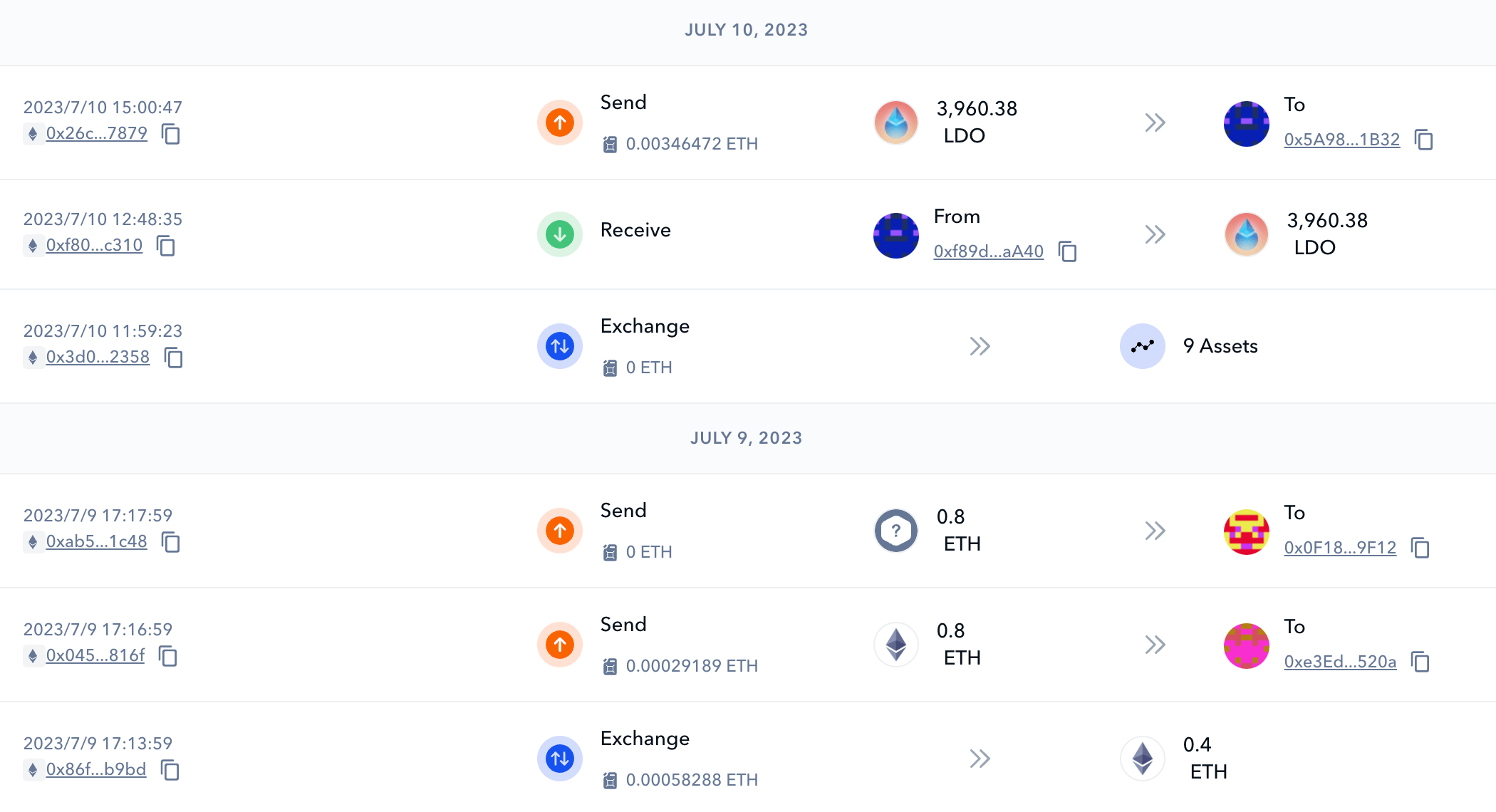

Historic Transactions Dashboard

The Transactions dashboard maintains a detailed record of all past blockchain activities, including trades, staking, lending, and other DeFi interactions.

This feature is invaluable for users who need to keep track of their transaction history for tax purposes, auditing, or simply to review their financial journey in DeFi. The dashboard provides a clear, chronological view of transactions, making it easier to analyze past strategies and their outcomes.

Antivirus Features: Scanner and Shield

Security is a top priority in DeFi and De.Fi’s antivirus features – Scanner and Shield – address this need effectively.

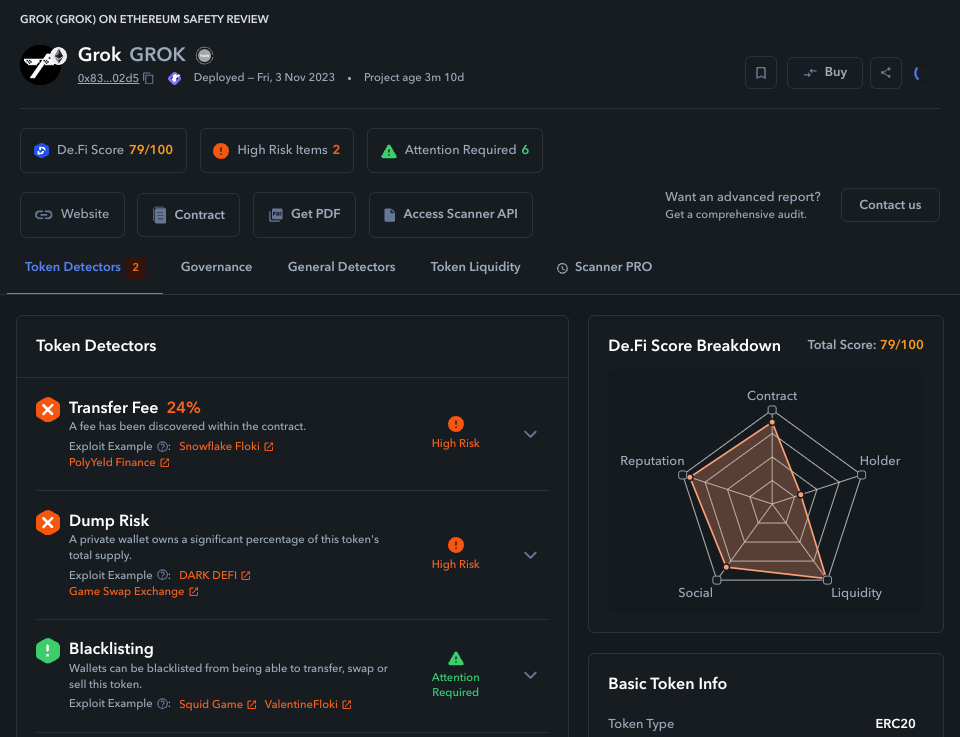

De.Fi Scanner

Security Scan for GROK on Ethereum

Scanner is a free smart contract auditor that allows users to audit new assets and protocols. It scans for vulnerabilities, providing a security report that helps users make informed decisions about engaging with new tokens or projects.

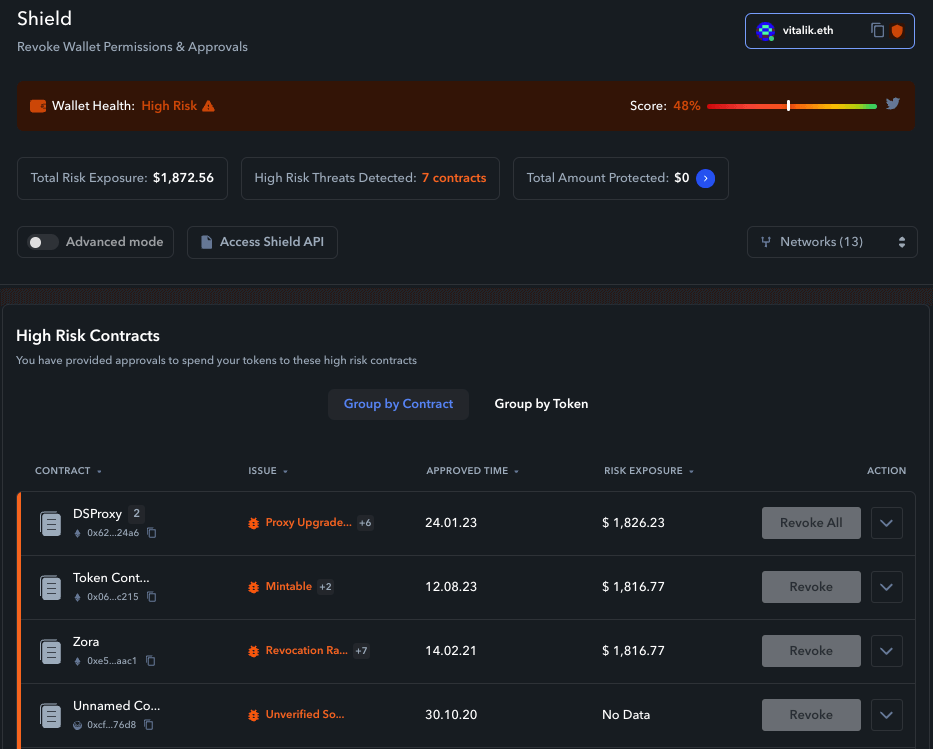

De.Fi Shield

A sample De.Fi Shield analysis

De.Fi Shield focuses on safeguarding wallet permissions. It reviews and manages the permissions granted to various dapps, ensuring that users’ DeFi wallets are not exposed to unnecessary risks. This tool is particularly vital in an ecosystem where smart contract exploits are prevalent.

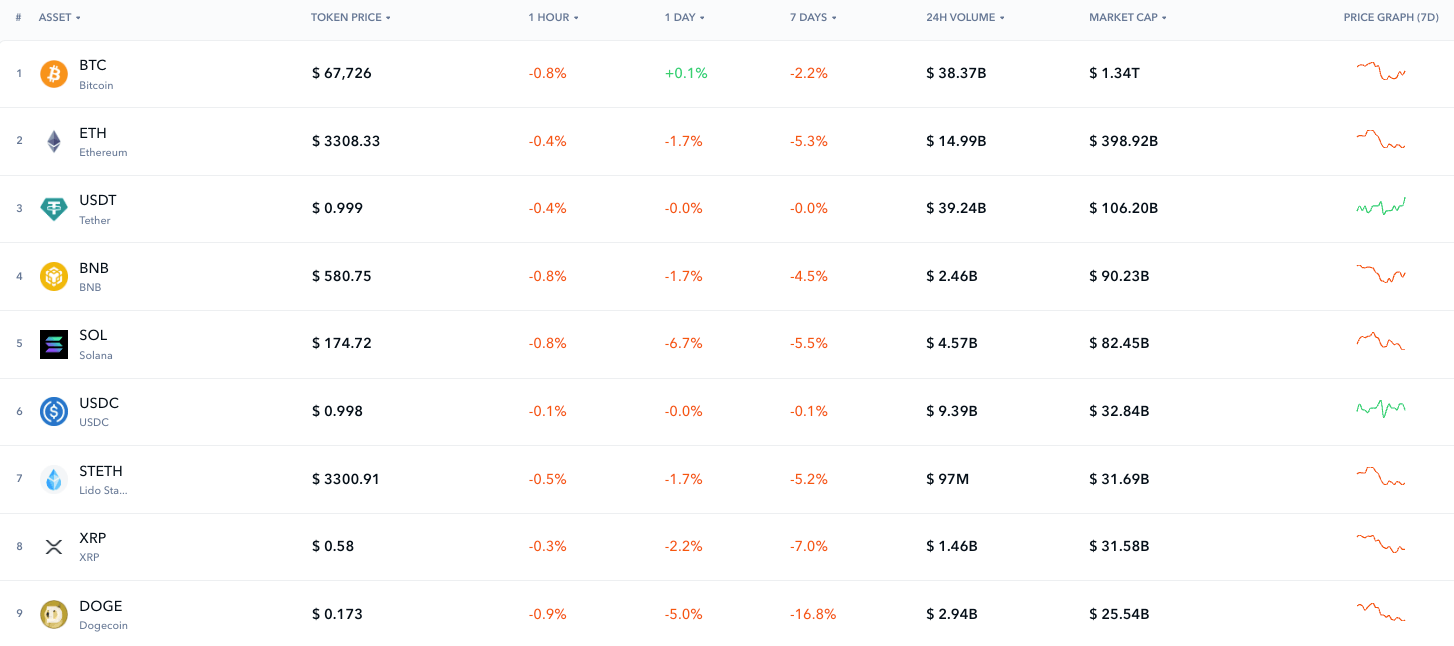

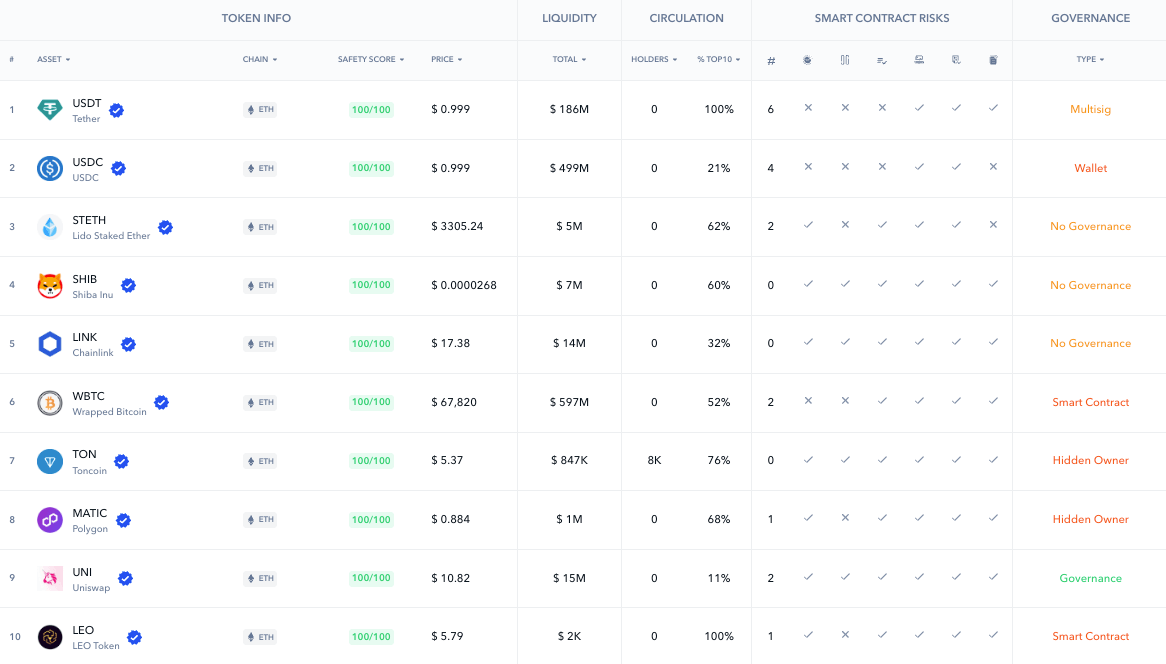

Token Market and Security Insights

De.Fi’s token market pages provide users with detailed information about various cryptocurrencies, including their performance metrics and security ratings.

This is complemented by the unique “CoinMarketCap of Security” page, which ranks tokens according to security level, and offers a deeper dive into the security aspect of tokens.

These insights are crucial for users who want to balance their portfolio’s financial performance with security considerations.

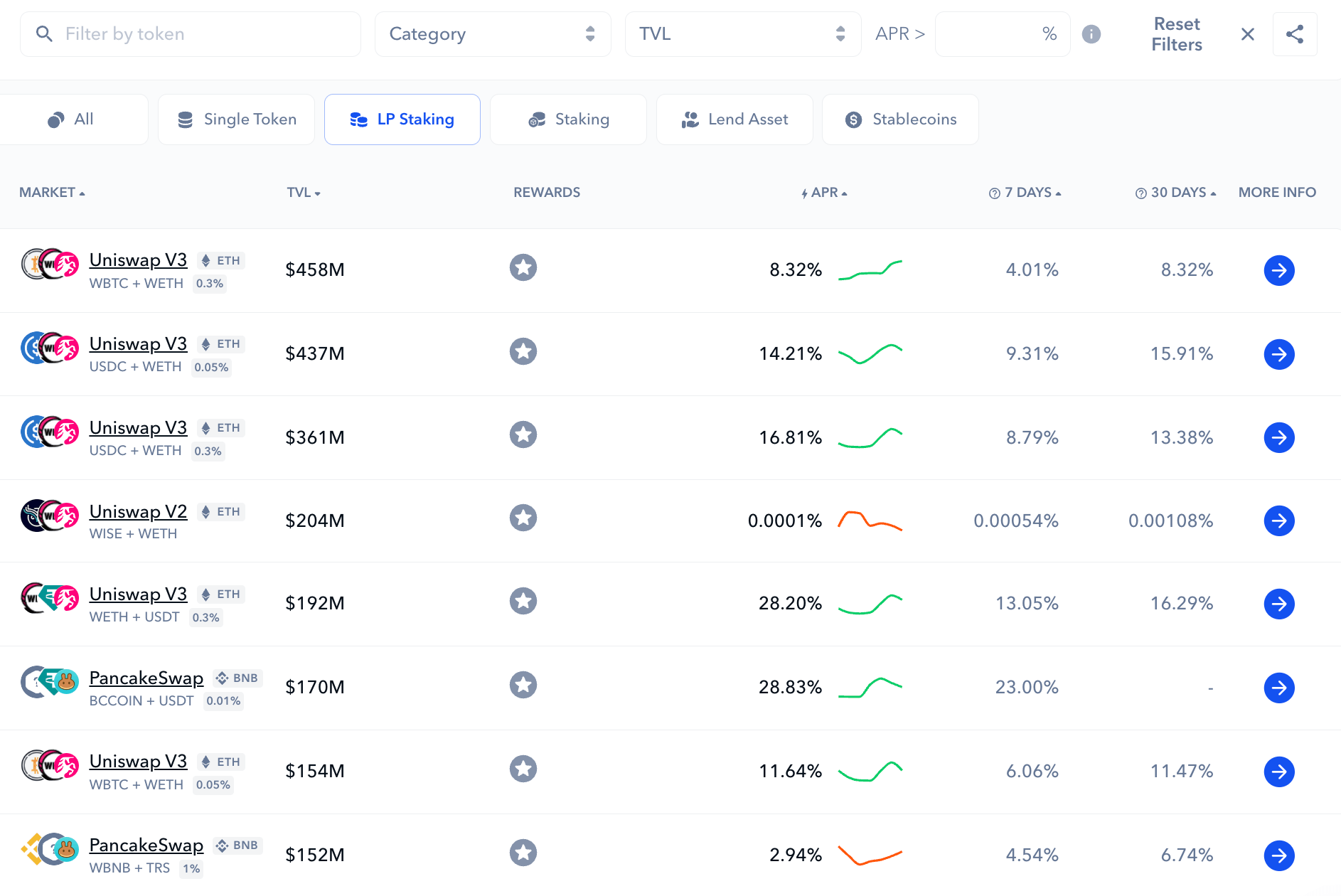

Explore Yields: Maximizing Asset Potential

Beyond the industry-leading dashboard, De.Fi also provides free access to our Explore Yields tool. This feature acts as a gateway to potential income streams in the DeFi space. It helps users discover and assess various yield farming and staking opportunities.

It is designed to maximize the earning potential of users’ assets by presenting a curated list of profitable opportunities in the DeFi landscape. Whether it’s high-yield farming options or secure staking protocols, Explore Yields provides a comprehensive view of where and how users can increase their digital asset holdings.

As you can tell, De.Fi’s extensive suite of features – from the in-depth Portfolio and Transactions dashboards to its innovative antivirus tools, market insights, and yield exploration platform – positions it as a fantastic alternative to Zapper. It provides a holistic and secure approach to managing and growing digital assets in the DeFi space.

Educating Yourself With De.Fi

Here at De.Fi, we not only build solutions for investors. We also recognize that staying informed and educated is as crucial as having the right tools for managing your portfolio. De.Fi therefore extends its services beyond just asset tracking, positioning itself as a comprehensive educational resource for its users. Here are some of the features you can look forward to.

In-Depth Research With Audit and REKT Databases

De.Fi’s commitment to user education is evident through its extensive audit and REKT databases. These platforms offer invaluable insights into the security and performance history of various DeFi projects, which are critical for informed decision-making in the DeFi space.

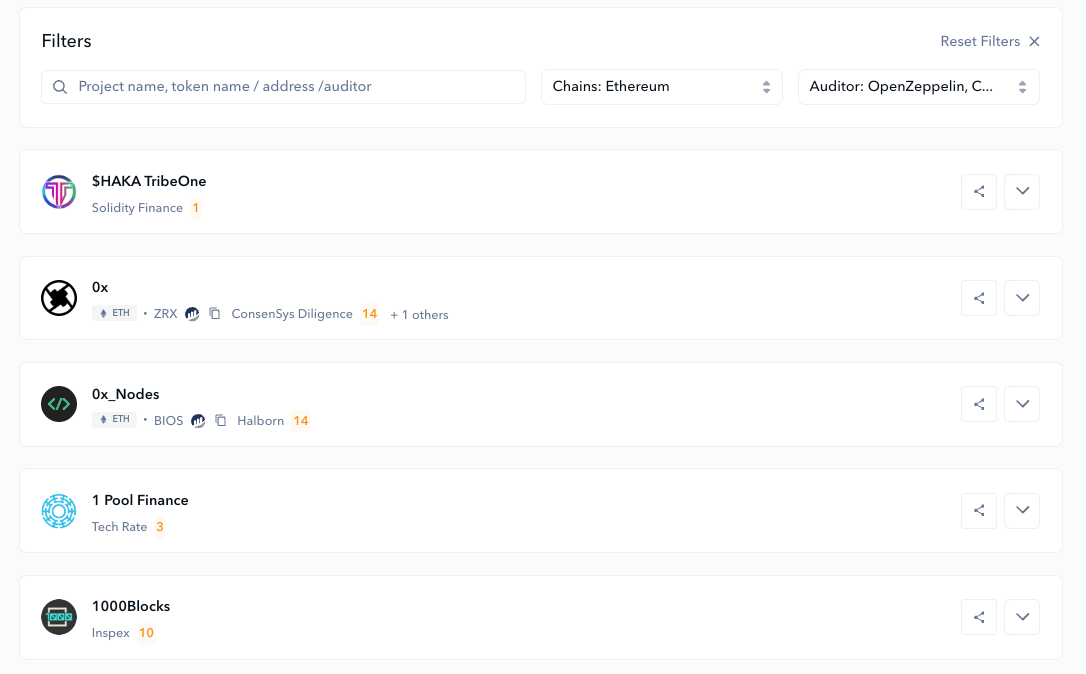

Audit Database

The Audit Database provides detailed evaluations of thousands of protocols. Each audit is meticulously carried out by blockchain security experts, ensuring that users have access to reliable and up-to-date information about the security standards of the projects they are interested in. This tool is indispensable for users looking to delve deeper into the technical and security aspects of DeFi projects.

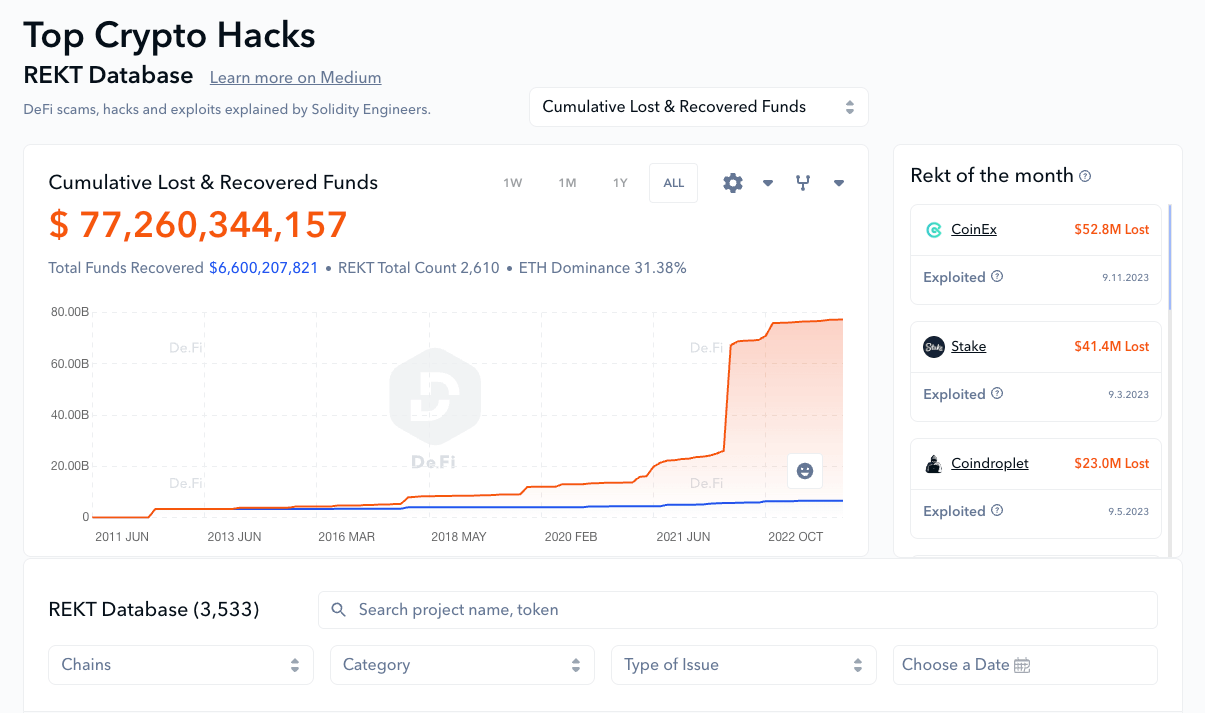

REKT Database

Understanding the history of exploits and security breaches is vital for navigating the DeFi landscape safely. The REKT Database serves this purpose by providing comprehensive breakdowns of past incidents in the DeFi and broader crypto space. This historical perspective is crucial for identifying patterns, understanding risks, and learning from the missteps within the industry.

The De.Fi Blog: A Gateway to Diverse Knowledge

The De.Fi blog is a dynamic platform, regularly updated with articles that cover a broad spectrum of topics relevant to the DeFi and crypto world. From market analyses and strategic investment tips to technical guides and the latest industry updates, the blog is a rich source of knowledge for both beginners and seasoned crypto enthusiasts. It helps users stay abreast of new developments, emerging trends, and key changes in the DeFi space.

Social Media Channels: Real-Time Updates and Community Engagement

De.Fi’s presence on social media, particularly through its dedicated X profiles and YouTube library, plays a significant role in its educational outreach.

X Profiles

De.Fi’s X accounts, De.Fi and De.Fi Security are not just about announcements and updates; they are platforms for real-time information sharing, discussions, and community engagement. Users can find quick updates on DeFi trends, security alerts, and educational content, fostering a well-informed community.

🚨REPORT: ~$415M WAS LOST IN Q1 2024🚨

• In Q1 2024, Crypto Lost 5% less than what was Lost in Q1 2023

• Top 3 Chains with the Most Hacks in Q1: $ETH, $BSC, $ARB

• The Biggest Hack: Chris Larsen EOA ($112.5M Stolen)

⚡️Report👇https://t.co/FPunSCfogY

— De.Fi Antivirus Web3 🛡️ (@De_FiSecurity) April 1, 2024

YouTube Library

For users who prefer visual and interactive content, De.Fi’s YouTube channel offers a wealth of resources. This includes interviews with industry experts, news coverage, in-depth walkthroughs of DeFi platforms, and tutorials.

These videos are designed to cater to various learning preferences and levels of expertise, making complex DeFi concepts more accessible to a broader audience.

Get Started Today With De.Fi

De.Fi presents itself as a holistic, feature-rich alternative to Zapper, addressing the diverse needs of DeFi users. From extensive asset tracking across multiple chains to robust security features and educational resources, De.Fi is well-equipped to cater to both novice and experienced users in the DeFi space.

Start with De.Fi today, and experience a comprehensive approach to managing and securing your DeFi assets.