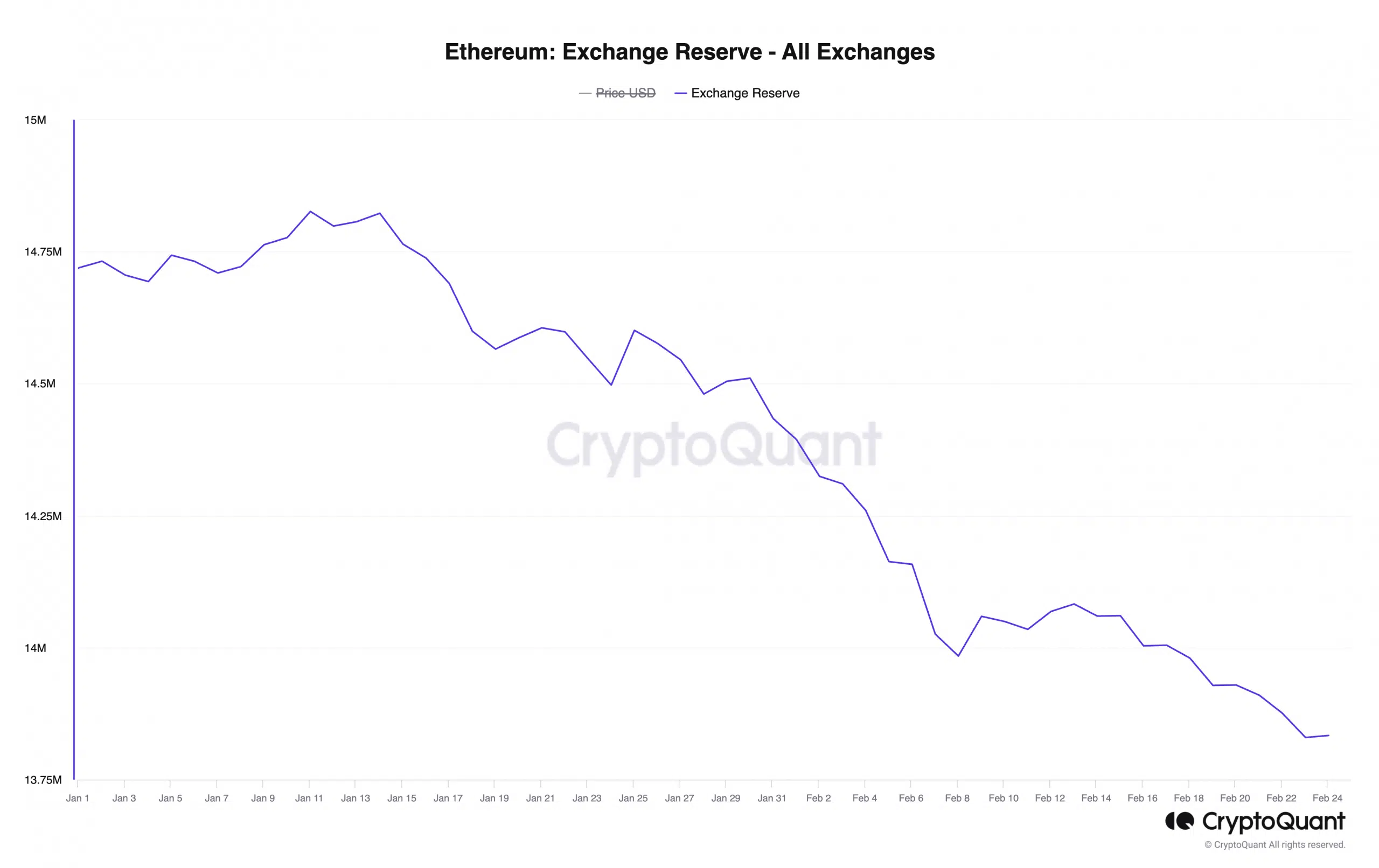

- Since the year began, ETH’s exchange reserves have plummeted.

- This showed that buying activity has since outpaced coin distribution.

Ethereum [ETH] exchange reserves have seen a significant net outflow of over 800,000 Ether, worth approximately $2.4 billion since the year began, according to data from CryptoQuant. This indicates that coin holders have been buying more ETH than they have been selling on exchanges since January.

At press time, information from the on-chain data provider showed that ETH’s exchange reverse was 13 million ETH, plummeting by 6% since the year began.

Due to the high accumulation volume, the year so far has witnessed an impressive growth in ETH’s value. Exchanging hands at $2,950 as of this writing, the price of the leading altcoin has gone up by 32% since the 1st of January.

ETH’s rally put many holders in profit

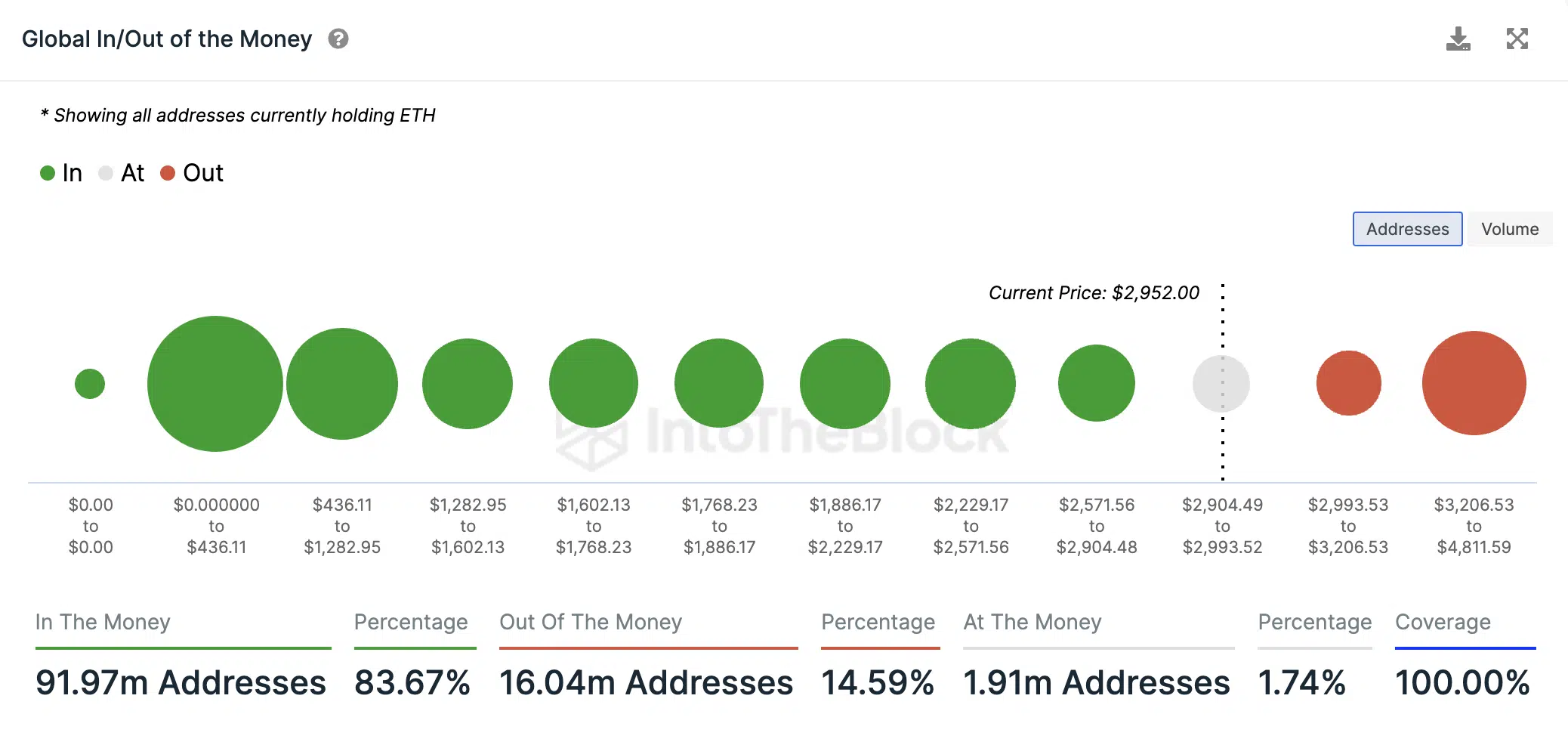

ETH’s recent spike above the $2900 price mark has put a significant number of its holders in profit.

According to data from IntoTheBlock, of all the addresses currently holding the altcoin, only 2 million addresses do so at a loss. These addresses acquired their coins when ETH traded within the price range of $2993 and $4811 during the bull market peak of 2021.

Conversely, a whopping 92 million addresses are “in the money.” This means that if any of these addresses sold their coins at current market value, they would realize profits on their investments.

To gauge the extent of profitability, AMBCrypto assessed ETH’s Market Value to Realized Value (MVRV) ratio on a 30-day moving average. Per Santiment data, this has climbed by 18% in the last month, moving from 50% to 59%.

With an MVRV ratio of 59% at press time, each ETH holder was guaranteed at least 50% profit if they sold their coins at the current market value.

Caution is necessary

As selling pressure dwindles, key momentum indicators assessed on a 24-hour chart were spotted in overbought zones. For example, ETH’s Relative Strength Index (RSI) and Money Flow Index (MFI) were 71.86 and 74.59, respectively.

At these values, a coin is deemed to be overbought. Buyers’ exhaustion is common at these highs, as market bulls often find it difficult to sustain further price rallies. This often results in a temporary price drawback.

In addition, the coin’s price traded significantly close to the upper band of its Bollinger Bands (BB) indicator, confirming the overbought nature of the market.

Is your portfolio green? Check out the ETH Profit Calculator

When an asset price approaches or trades above this upper band, it means that the asset’s value has risen significantly compared to its recent average levels.

Traders often interpret this as a sign that the asset may be reaching a short-term peak in price, and a potential reversal could be on the horizon.