With all of the regulatory hurdles Binance, the biggest cryptocurrency change by buying and selling quantity, has confronted over the previous months, traders have taken a cautious strategy towards the change.

It began with the US commodity futures buying and selling fee (CFTC) taking authorized motion towards Binance for violating the Commodity Trade Act (CEA) in March 2023. The initiation of the lawsuit shook the crypto market, with the Bitcoin (BTC) worth falling from $27,700 to $26,600.

Regardless of Binance and its CEO Changpeng Zhao’s (CZ) try to dismiss CFTC’s lawsuit, a survey taken in collaboration with BTC Friends — involving 1,273 crypto merchants internationally — shows that 45% of the merchants imagine there’s a reputable chance of Binance’s collapse.

Nonetheless, 55% of the remaining survey-takers voted for Binance’s market dominance regardless of the excessive competitors and tight regulatory scrutiny.

“Binance’s future is unsure. It may not collapse if it could deal with regulatory issues, enhance safety measures, and keep customers’ belief. However, if it fails to take action, a collapse is feasible.”

David Gokhshtein, the founding father of Gokhshtein Media, advised crypto.information.

Regulators vs. Binance

On June 5, the US Securities and Trade Fee (SEC) filed a lawsuit towards Binance and CZ for violating the securities regulation — claiming that Binance has allegedly requested clients to commerce digital belongings on unregistered platforms within the US.

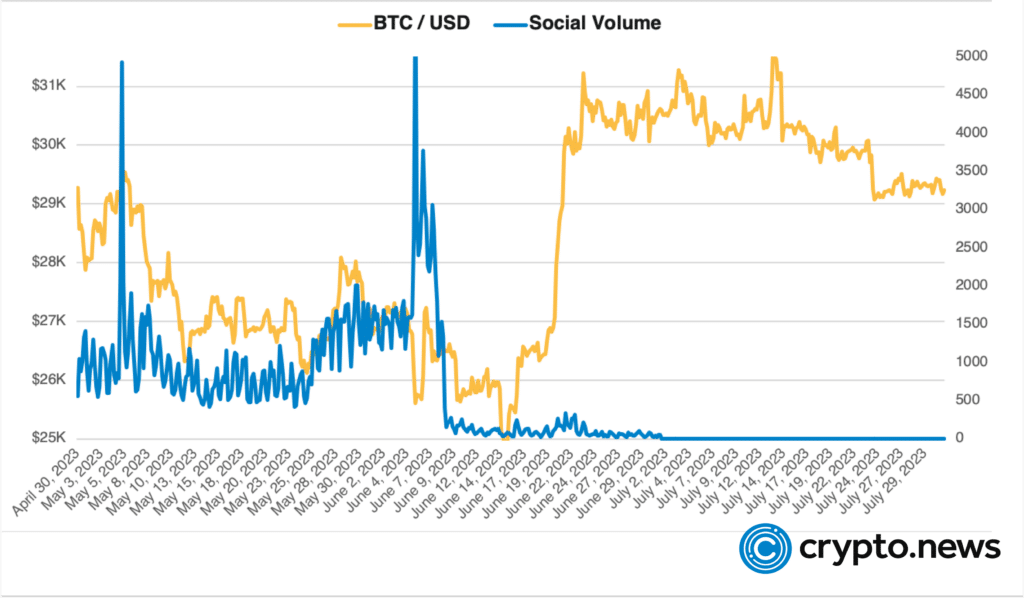

In line with information offered by Santiment, the social quantity for the time period “Binance collapse” skyrocketed on June 6 whereas the BTC worth fell beneath the $26,000 mark. Since June 9, the warmth round the opportunity of the change’s shut down has dropped considerably.

Gokhshtein, who can also be a distinguished investor, believes that “an important consideration is the necessity for regulatory compliance within the crypto area.” To construct long-term belief within the business, crypto exchanges must adjust to the regulators whereas taking transparency into consideration.

Furthermore, after the SEC’s lawsuit, BinanceUS has eliminated crypto-fiat buying and selling pairs from its platform and inspired traders to transform their US greenback holdings to stablecoins. The change even hinted at discontinuing USD withdrawals.

A Wall Avenue Journal (WSJ) report revealed that Changpeng Zhao was conscious of and “directed” the wash buying and selling actions at BinanceUS. Per WSJ, Binance has additionally wash traded round 46% of its world buying and selling quantity.

Furthermore, the change was below investigation by French authorities for alleged cash laundering. On July 23, a report revealed that Binance France has been holding roughly €1 billion in crypto belongings.

“If the cash laundering and different accusations towards Binance grow to be true, it might have critical penalties for the change and the crypto ecosystem. There is perhaps regulatory crackdowns and a lack of confidence from customers and traders.”

David Gokhshtein, the founding father of Gokhshtein Media.

It’s not solely the US that Binance has been fighting. On July 5, the Australian Securities and Investments Fee (ASIC) raided the places of work of Binance Australia’s derivatives division.

Moreover, Binance withdrew its crypto license utility in Germany on July 26 because of the nation’s tight laws.

However, Binance announced to re-enter the Japanese market in August after the acquisition of the regionally regulated Sakura Trade BitCoin in November final yr. It’s necessary to notice that the change was pressured to depart Japan as a consequence of excessive regulatory scrutiny in 2018.

Following the regulatory scrutiny worldwide, Binance has laid off 1,000 staff with a chance of three,500 folks dropping their jobs earlier than 2024.

The domino impact on the crypto market

Per the survey, 60% imagine that Binance’s collapse might put the crypto market on fireplace for the reason that change has over $63.1 billion in digital belongings. In line with data by CoinGlass, there are 555,502 Bitcoins on Binance — price roughly $16.26 billion on the time of writing.

“The way forward for Bitcoin is unsure, however having over 550,000 BTC in an change can doubtlessly impression its worth. If a good portion of these Bitcoins are bought off, it might result in a short lived drop in worth.”

David Gokhshtein, the founding father of Gokhshtein Media.

As well as, 70% of the respondents to the survey anticipate a large Bitcoin worth crash, whereas 30% imagine it “would stay secure.”

Gokhshtein claimed that if belongings held by Binance are misplaced as a consequence of “hacks or mismanagement,” it might lead to “vital losses for customers.” “The extent of the loss would depend upon the particular circumstances,” he added.

Furthermore, the collapse might considerably have an effect on the traders’ sentiment across the Binance Sensible Chain (BSC) and its related tasks. At the moment, there are a complete of 571 decentralized finance (DeFi) protocols built and/or related on BSC with a complete worth of round $3.35 billion, per DeFi Llama.

Knowledge offered by Dapp Radar shows that 4,898 decentralized functions (dApps) have been developed on BSC.

Gokhshtein added that if one thing occurs to BSC, it will have a unfavorable impression on all of the cryptocurrencies developed on it and the BNB ecosystem. “Relying on the severity, it might result in a lack of belief and worth for these belongings,” he concluded.

The BSC crew denied commenting on the opportunity of Binance’s collapse whereas calling itself a totally “separate entity.”

“Our accountability lies in guaranteeing the integrity and performance of the BNB Chain blockchain and supporting the group of tasks constructed on it. As well as, the BNB Chain ecosystem is decentralized and constructed to function independently of particular entities.”

A BSC spokesperson for BSC advised crypto.information.

Crypto traders’ choices

The BTC Friends survey additionally revealed that 55% would migrate to different centralized exchanges (CEXs) if Binance fails. The remaining 45% would favor to change to decentralized exchanges (DEXs) if the biggest CEX ever collapses.

Per BTC Friends, 65% of the respondents claimed that the broader crypto ecosystem’s innovation and progress can be put in danger if Binance fails, however the remaining 35% say the shut down might open new alternatives.

75% say they might nonetheless keep within the “crypto market even when Binance collapsed,” whereas 25% desire to depart the business “a minimum of quickly.”

Binance didn’t reply to a request for remark from crypto.information.

In the end, it’s laborious to inform whether or not Binance collapses or not, however the laborious stress from the governments and regulators has confirmed to be inevitable.